Strategic Partnerships for Resilience: Bagley Risk Management

Just How Animals Risk Protection (LRP) Insurance Policy Can Safeguard Your Animals Investment

Animals Danger Defense (LRP) insurance policy stands as a reputable shield versus the unpredictable nature of the market, offering a tactical technique to protecting your assets. By delving into the complexities of LRP insurance policy and its diverse benefits, livestock manufacturers can strengthen their investments with a layer of safety that transcends market fluctuations.

Comprehending Animals Danger Security (LRP) Insurance

Recognizing Livestock Danger Protection (LRP) Insurance is necessary for livestock producers looking to reduce financial threats related to rate fluctuations. LRP is a government subsidized insurance policy item developed to safeguard producers against a decrease in market rates. By supplying protection for market cost declines, LRP helps producers secure a floor cost for their livestock, guaranteeing a minimal degree of revenue no matter market changes.

One trick facet of LRP is its adaptability, enabling producers to personalize insurance coverage degrees and plan lengths to fit their specific demands. Producers can select the number of head, weight range, coverage rate, and coverage period that align with their manufacturing objectives and run the risk of tolerance. Recognizing these customizable options is vital for producers to efficiently manage their cost danger exposure.

Moreover, LRP is available for numerous livestock kinds, including cattle, swine, and lamb, making it a versatile danger monitoring device for livestock producers throughout various sectors. Bagley Risk Management. By familiarizing themselves with the details of LRP, producers can make educated choices to protect their financial investments and make certain financial security despite market uncertainties

Benefits of LRP Insurance Policy for Animals Producers

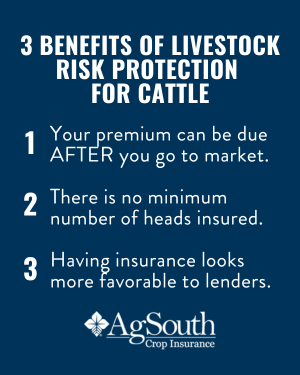

Animals producers leveraging Livestock Risk Security (LRP) Insurance get a strategic advantage in protecting their financial investments from cost volatility and securing a stable financial footing among market uncertainties. By establishing a flooring on the rate of their livestock, producers can reduce the risk of substantial monetary losses in the occasion of market declines.

Moreover, LRP Insurance policy provides producers with tranquility of mind. On the whole, the benefits of LRP Insurance for livestock manufacturers are considerable, providing an important device for handling threat and making sure monetary protection in an uncertain market setting.

Exactly How LRP Insurance Policy Mitigates Market Risks

Reducing market threats, Animals Threat Defense (LRP) Insurance gives livestock manufacturers with a trusted shield against price volatility and monetary uncertainties. By providing defense against unexpected price drops, LRP Insurance coverage aids manufacturers safeguard their financial investments and preserve monetary security in the face of market changes. This kind of insurance policy enables livestock producers to secure a price for their pets at the beginning of the plan duration, ensuring a minimum price degree despite market modifications.

Steps to Secure Your Livestock Financial Investment With LRP

In the realm of agricultural risk management, executing Animals Danger Protection (LRP) Insurance coverage entails a calculated process to safeguard investments against market fluctuations and unpredictabilities. To protect your animals financial investment successfully with LRP, the very first step is to assess the specific threats your operation deals with, such as rate volatility or unanticipated climate events. Comprehending these dangers allows you to establish the insurance coverage degree required to protect your financial investment effectively. Next off, it is crucial to study and pick a respectable insurance policy service provider that offers LRP plans tailored to your animals and organization needs. Once you have actually picked a company, meticulously assess the plan terms, problems, and insurance coverage limits to guarantee they line up with your risk administration objectives. Furthermore, consistently keeping track of market fads and changing your coverage as required can assist enhance your protection versus potential losses. By following these actions vigilantly, you can improve the safety and security of your animals investment and navigate market unpredictabilities with confidence.

Long-Term Financial Safety And Security With LRP Insurance Coverage

Guaranteeing enduring financial stability through the usage of Livestock Threat Security (LRP) Insurance coverage is a prudent long-term approach for farming manufacturers. By integrating LRP Insurance coverage into their risk monitoring strategies, farmers can secure their livestock financial investments against unanticipated market variations and unfavorable events that can jeopardize their economic wellness with time.

One secret advantage of LRP Insurance policy for long-lasting economic safety is the satisfaction it provides. With a reliable insurance coverage in position, farmers can alleviate the financial threats associated with volatile market conditions and unforeseen losses because of aspects such as condition break outs or all-natural catastrophes - Bagley Risk Management. This stability allows manufacturers to click here to read concentrate on the day-to-day operations of their animals business without continuous stress over possible monetary troubles

Furthermore, LRP Insurance coverage supplies a structured technique to you can look here managing danger over the long-term. By establishing specific protection levels and selecting appropriate endorsement durations, farmers can tailor their insurance policy prepares to align with their financial goals and risk resistance, making certain a lasting and protected future for their livestock procedures. In conclusion, buying LRP Insurance is an aggressive strategy for farming manufacturers to accomplish long-term monetary security and safeguard their source of incomes.

Verdict

In conclusion, Livestock Danger Defense (LRP) Insurance coverage is an important device for animals producers to alleviate market threats and safeguard their investments. It is a wise choice for guarding livestock investments.